Agiblocks is a toolkit filled to the absolute brim with smart equipment to streamline your day to day in the commodity trade, and it has been since the word go. In an earlier update on integrations & microservices, we shared a list of our top 5 of ERP systems we integrate with. In this follow-up, we’d like to highlight some of our many microservices.

As an advanced operating software, Agiblocks hosts several microservices on managed containers. Microservices are an architectural and organizational approach to software development where software is composed of small independent services that communicate over well-defined APIs. These services are owned by small, self-contained teams.

They are critical to traders, especially when managing logistics – which is why we’ve made them all part of one ecosystem.

Sitagri Infinite

The Sitagri Infinite platform brings all your data needs together in a single universe. Whether it be derivative and physical commodity quotes, international news, reports, statistics, charting tools, technical and fundamental analyses, weather, or freight and tenders, you can find it all in one user-friendly SAAS environment. It offers a modern, customizable, comprehensive and easy-to-use platform. It’s also one hundred percent web-based, so it’s accessible anywhere and everywhere. SitagriPro Infinite requires no installation and is available for Chrome, Firefox and Safari. SitagriMobile is available for both iOS and Android, allowing you to easily access your data on any device.

The app is set up in such a way to organize your favorite products in customizable portfolios. Follow the markets in real time 24/7, consult news, read Sitagri Market Reports analysis and keep up to date with trends, wherever you are.

Agiboo & Big Wave BI

Talking about smarter tools – have you read about our recent partnership with Big Wave BI, the specialized PowerBI service provider that has a very special role in Agiblocks 4.0?

Big Wave BI transforms your existing sources of data into custom-built dashboards that instantly reveal your business trends so you can make meaningful decisions quickly and free your mind for creative thinking.

Big Wave BI is specialized in coffee, cocoa, sugar, cotton and grains and are true experts in the Agiblocks CTRM data models. They provide reports and business analytics on Agiblocks CTRM and offers specific integrated features such as Agiblocks CTRM ShipsGo Integration.

CommodityAI

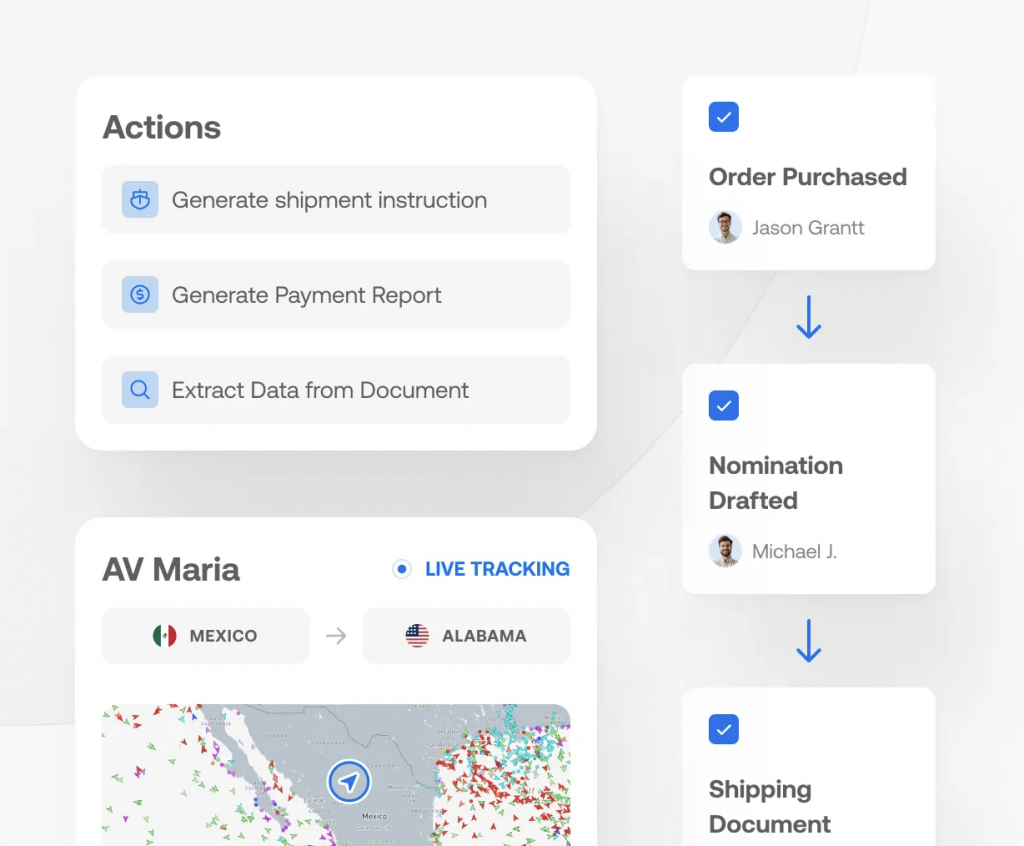

CommodityAI improves how commodity traders and distributors manage their daily workflow, by enhancing your control over your commodity trading operations through end-to-end shipment management, advanced tracking and AI-driven performance insight.

With an aim of creating the digital infrastructure to eliminate inefficiencies in commodities trading, they’re focusing on a universal challenge that’s inherent to commodity companies: maintaining agility and control over ever-changing commodity supply chains.

One of their customers, a US-based sugar trader and distributor, uses CommodityAI to gain greater visibility and control over inbound and outbound ocean shipments. The platform enables them to classify documents, extract relevant fields, and organize them by shipment. They take unstructured data from documents and ERP systems and convert it into structured data, made AI-ready and packed into powerful automation that lets you hand off low-value, error-prone tasks like sending shipment status updates and generating vessel nominations.

We’ve partnered up with CommodityAI to integrate their next level AI platform into our flagship CTRM software solution – unlocking a myriad of fresh advantages for the commodity trading industry at large.

AgFlow RiskMgmt

With AgFlow’s RiskMgmt API product, risk managers can access complete one-year cash forward curves for both bid and ask prices to adequately mark-to-market their trading portfolio and correctly assess their Value-at-Risk (VaR). AgFlow’s solution removes all the hurdles faced when working with incomplete cash forward curves. You do not have to collect data from multiple sources, or have to worry about computational resources, while at the same time reducing the risk of introducing errors in analyses through manual input.

Thanks to Risk Mgmt API, you know the value of what is in your books and can easily bridge the information asymmetry between trading and risk management. You can accelerate your mark-to-market, VaR and P&L calculations, because the data is ready for you to plug and play. And you add accuracy and power to your risk management reporting using independent, unbiased, reliable and backtested data. Through the API you can access all the latest market differentials on Corn, Soybeans, Wheats and over 75 more commodities, including completely unique 12-month cash forward curves.

“We empower agricultural commodities buyers, sellers, risk managers, investors and movers with accurate, clean and privileged data from unbiased sources. It saves you time and money, while increasing efficiency, productivity and competitivity.”

In other words, do you wish to forget about going through dozens of market reports, digging into hundreds of emails and spending hours on the phone – every day? Weeding out irrelevant data points, cleaning and structuring raw data into something useful? Then AgFlow’s RiskMgmt API might be the solution for you. It helps cutting down on all of your multiple subscriptions to data providers to boot.