We probably see at least one article every day popping up on our LinkedIn page about blockchain technology. Sure, it is something new and worth to know, but still, can blockchain change the whole concept of how we exchange value in commodity trade industry?

“Blockchain” in simple words

A blockchain is a list of digital records (blocks), which have a connection with each other, they are secured and play the role of public ledger of all cryptocurrency transactions.

Sure, sounds simplified enough, but still, how would you describe it to your 10 year old kid?

“So, kid, imagine that instead of dollars we use another currency, not physical, but digital. That’s Bitcoin. Even though dollars and other types of currencies have a central authority control, Bitcoin doesn’t. This means, we have no banks in the middle when we want to make a purchase thus there is not any one keeping formal record of the payment. It’s just us and the seller. This is blockchain!”

Well, probably now it is way too simple. However the kid probably has a better view on the basic term of blockchain. How does it work though?

How it works

By providing such a platform where Bitcoin overcomes all the difficulties of traditional banking, blockchain acts like a distributed public ledger and everyone has a copy of all transactions ever occurred. Don’t panic! Everything run under hash encryption, in this way everyone can see the transactions without accessing your personal details and information of your transaction.

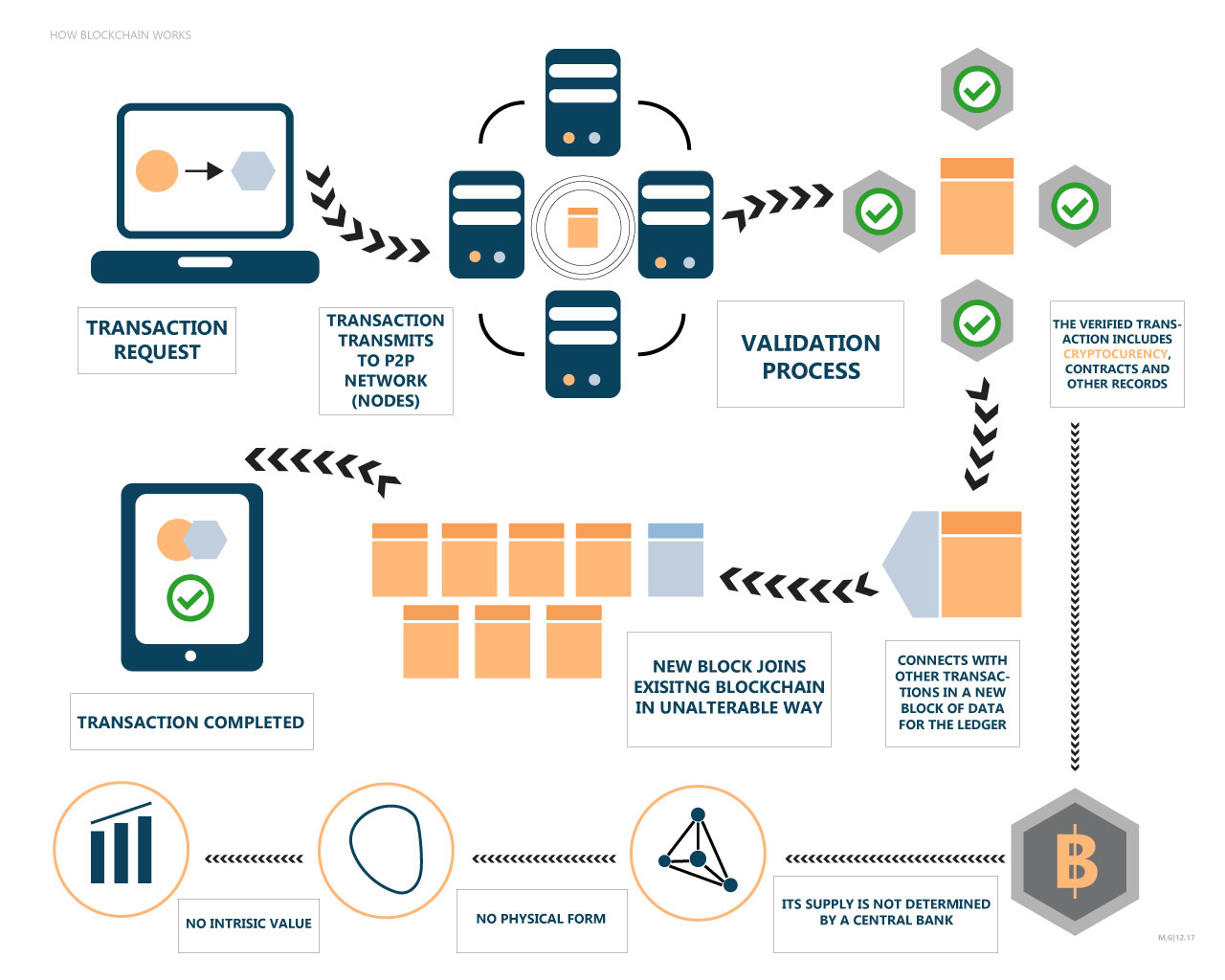

Too many words again! Can you draw it for me? Sure, let’s make it even fancier for our eyes and see how it works:

Now that we have a common ground about blockchain and how it works, let’s discuss about the world of commodities.

Blockchain technology in commodity trade

This public ledger technology gives promising solutions to financial transactions and services also in the industry of commodities trading. What is the need of clearing houses if we can have the chance of automated post-trade “smart contracts”? Well, it seems easy but still looks like a path where no one has ever walked on it.

Trading soft commodities requires besides market volatility, also management of supply chain and counter party, risk. The concept of blockchain could make a good fit for tracking these physical commodities along the supply chain, where a lot of transnational procedures are still recorded on paper. When you have the benefit of managing all the title transfers electronically through a distributed public ledger, certified by any counter party of the supply chain, it could eventually increase trust between the market players (and reduce counter party risk) and ease hedging processes due to elimination of clearing.

We are all convinced that technology will change a lot of things and eventually transform the sector of commodities trading. Even the ones who still keep the traditional mindset of keeping most records in paper and spend hours and days in organizing their book cases, oh yes, even the ones who right now are checking the newest contracts in their Excel sheet. However, there is a long way to feel secured and let technology overcome our businesses in that extend.

We can, though, make baby steps in accepting the reality. Implementing commodity trading and risk management software, powerful enough, which can be our “friend” in a daily routine of a trader, is probably one of the first steps. Only once you have digitized the transaction and trade management process you can make a step towards blockchain.

Conclusion

In a nutshell, blockchain is the future for transaction validation and now is starting becoming the present in a variety of transnational environments. This technological concept is triggering the foundation of a new era in commodity trade and an inspiration for the CTRM software solutions providers. At this point in time we definitely can’t answer right away with a “Yes” or “No” the question “Is blockchain changing the world of commodity trade?”. We could all agree that evolution of things is humanity’s moving force, Information Technology being the evidence of this philosophy. From that perspective information technology and the commodity trade industries are bound to become close friends on the longer term. And the best way to anticipate that friendship is to invest in and keep your technology platform updated.